Energy Private Equity In ‘Holding Pattern’ As Exits Prove Difficult

Originally Published in Forbes By Hana Askren and Chad Watt on October 11, 2018

Private equity portfolios are brimming with energy businesses ready to exit, yet options remain narrow, according to several sector experts.

“There are a lot of processes out being run” for energy portfolio investments between three and five years old, says one industry banker. But “it’s hard to get people to show up,” he says, adding that the sector is in a “weird kind of holding pattern.”

Many public buyers in services and upstream exploration and production have been forced to the sidelines. Energy services companies lack liquidity and their shares are not trading high enough to facilitate such deals, thinning the buyer landscape, according to the banker. Meanwhile, public E&P operators are absorbed in meeting investors’ demands for capital discipline and in finding alternatives to out-of-favor acquisition strategies that simply add acres and reserves, notes a second banker.

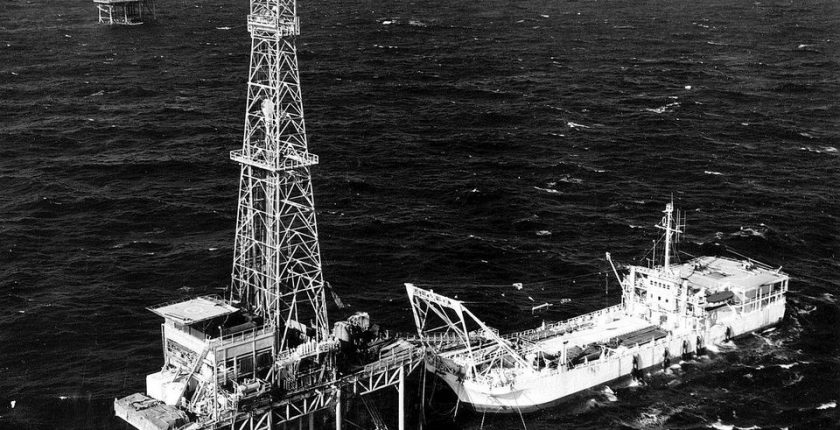

Image: Tender-Patform Rig. Offshore, Louisiana. c. undatedENERGY.GOV